snohomish property tax payment

2022 Point Pay. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

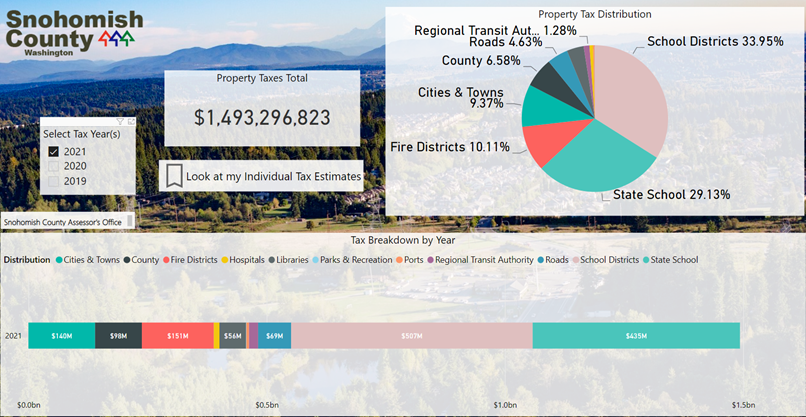

Homeowners Worry As Snohomish County Property Taxes Rise Over 34 In 5 Years

Heres what you need to know about paying your Snohomish County property taxes by phone.

. Welcome to the City of Snohomish online credit card debit card and e-check payments portal. To get help with online payments either email the treasurer with. Ad Pay Your County of Washington Bill with doxo Today.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related Phone. PO Box 1100 Everett WA 98206-1100. Use the search to locate and pay your bill with Quickpay instead.

Please refer to the back of your tax statement to determine eligibility or you may contact the Snohomish County Assessors Office at 425-388-3540 for additional information. Find Snohomish County Online Property Taxes Info From 2022. 425-262-2469 Personal Property.

The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. Prefer not to login. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706.

Make a one time payment below using your Parcel ID OR use the Create an account link to. Snohomish County Treasurer 425-388-3366. Doxo is the Simple Secure Way to Pay Your Bills.

1-Utility Bill Payment 2-Payments for. To pay by phone youll need to call the Snohomish County Treasurers Office at 425. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706.

You must have an existing account before you can sign in with Google. Help with Online Payments. Snohomish County collects on average 089 of a propertys.

Once you have registered for a Paystation account you can instantly access and manage your bills from Snohomish County. Taxes Tax Rates and Information For rate questions visit Washington State Department of Revenue or call 800-547-7706. You will need a current statement from Snohomish County to.

The county will post the payment to your account on the third business day following payment. Ad Search Any Address in Snohomish County Get A Detailed Property Report Quick. Pay for services online.

Pay Your Bill with doxo. Please select below the type of payment you are making. Taxes Tax Statistics For rate questions visit Washington State Department of Revenue or call 800-547-7706.

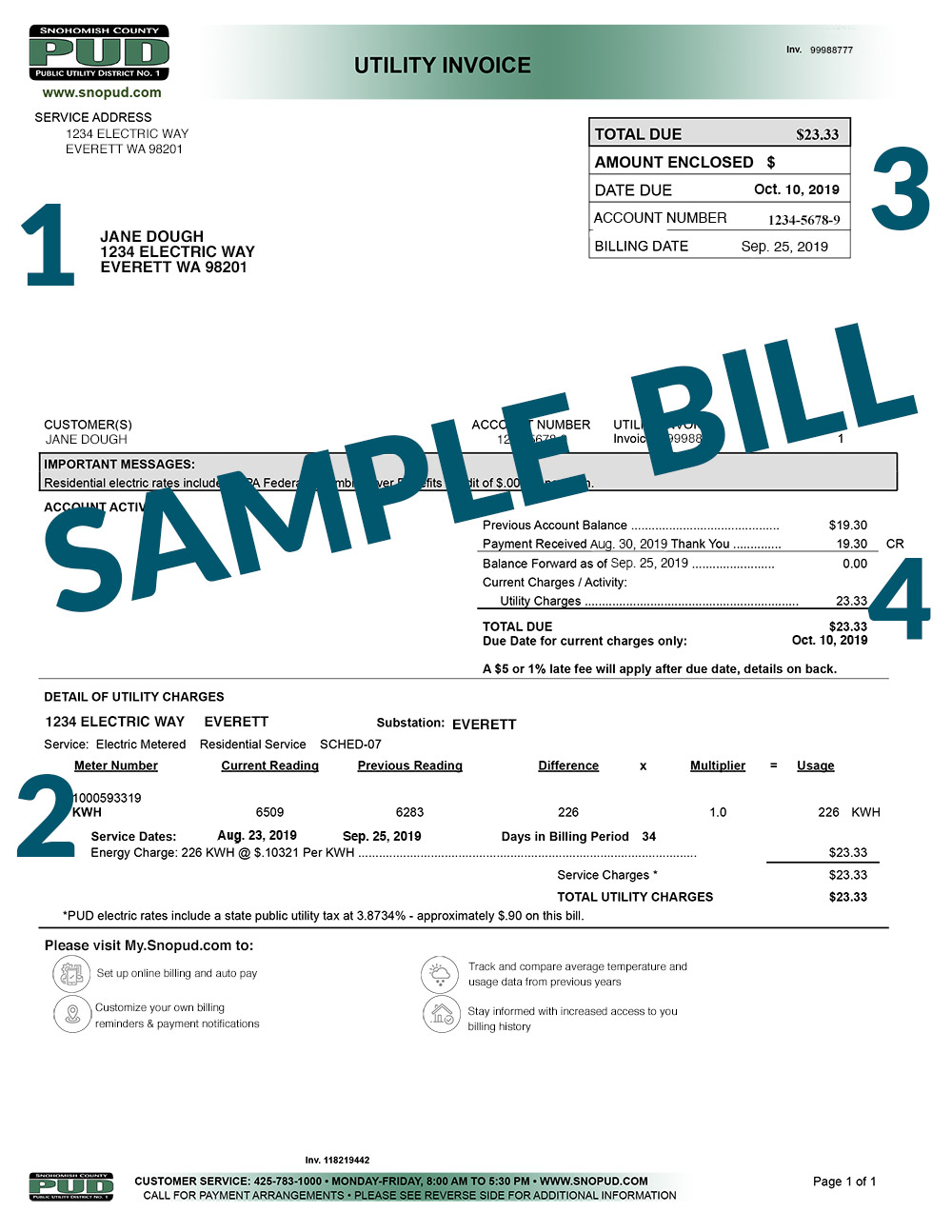

The Assessor and the Treasurer use the same software to record the value and. The PUD offers a variety of convenient secure payment options online over the phone and in person.

News Flash Snohomish County Wa Civicengage

My Billing Statement Snohomish County Pud

About Efile Snohomish County Wa Official Website

Property Mls 1693341 10413 240th Place Sw Edmonds Wa 98020 In Snohomish County Wa Has 4 Bedrooms 1 Bathroo Backyard Views Low Maintenance Yard Large Sheds

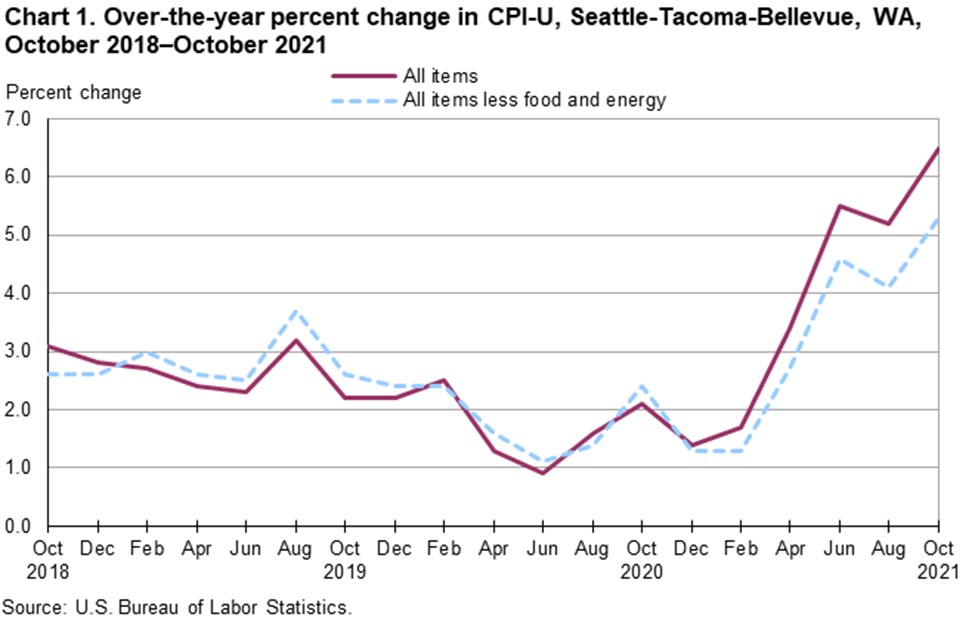

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

How To Read Your Property Tax Statement Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Snohomish County Property Values Increasing Rapidly King5 Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Graduated Real Estate Tax Reet For Snohomish County

Tax Payment Options Snohomish County Wa Official Website

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com